Check out our Ramadan offer🌙 ! Learn More

Accelerate Your Career with Strategic Financial Expertise

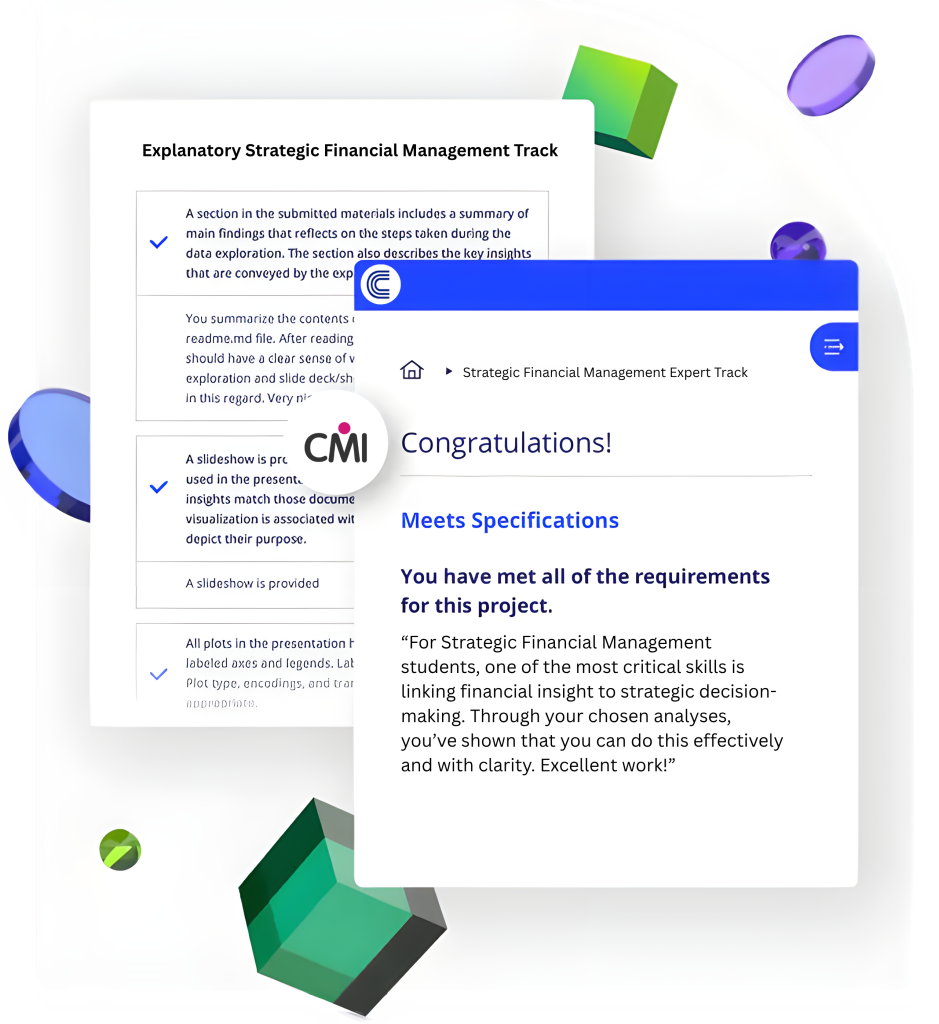

Position yourself among elite financial leaders by mastering advanced strategic planning and financial management skills accredited by the Chartered Management Institute (CMI).

- Learning Languages: Available in Both Arabic and English.

- Self-paced study supported by personalized one-to-one sessions from our experts.

- Total Learning Hours: 45 Hours.

- Program Duration: 3 Months Access on The Track Materials.

- Level: Mid to Senior-Level Professionals.

- Certification: CMI Certificate.

Why Earn The CMI Strategic Financial Management Expert Track?

- Earn the Prestigious fCMgr Badge: Gain international recognition with the distinguished Chartered Manager (fCMgr) status, showcasing your superior management skills.

- Accelerate Your Career Growth: Strengthen your professional profile with skills directly linked to increased business performance, 74% of certified professionals report substantial organizational revenue growth.

- MBA Integration: Complete 30% of an MBA program's curriculum, providing you with a robust foundation for further academic and professional advancement.

- Exclusive Learning Resources: Receive one-year free access to ManagementDirect, an extensive online library of financial strategies, tools, and industry-specific case studies.

- Practical and Flexible Learning: Experience flexible online learning sessions and real-world practical assignments tailored to suit your professional and personal schedules.

Track overview

This expert track equips you with advanced skills in financial analysis, strategic planning, resource management, and risk assessment, enabling you to effectively implement financial strategies aligned with business objectives. It empowers professionals to become strategic financial leaders who significantly impact organizational growth and sustainability.

Track Outcomes

Resource allocation skills

Book A Session and Improve your skills!

Risk management expertise

Book A Session and Improve your skills!

Value maximization

Book A Session and Improve your skills!

Strategic decision-making

Book A Session and Improve your skills!

Sustainable growth techniques

Book A Session and Improve your skills!

Strategic HR decision-making

Book A Session and Improve your skills!

Performance metrics alignment

Book A Session and Improve your skills!

Regulatory compliance

Book A Session and Improve your skills!

Investment analysis

Book A Session and Improve your skills!

Budgeting and forecasting

Book A Session and Improve your skills!

Awarding Body

Gain the expertise to develop and implement cutting-edge marketing strategies that align with business objectives and significantly enhance your market competitiveness.

Know More Included Certificates & Curriculum

Duration: 45 Hours || Assessment: Research Paper Submission

1. Strategic Planning

Duration: 15 Hours || Assessment: Research Paper Submission

Unit 1: Foundations of Strategic Marketing Management

Understand the core principles of strategic planning and its role in shaping a business's future. Learn how mission, vision, and objectives align with broader business planning strategies to achieve organizational success.

Lessons:

- Mission and Vision

- Objectives and Goals

- Strategies and Tactics

- Strategic Planning

- Core Organizational Values

- Cultural Diversity

- Profit and Market Share

Unit 2: Strategic Analysis Methodology

Understand the core principles of strategic planning and its role in shaping a business's future. Learn how mission, vision, and objectives align with broader business planning strategies to achieve organizational success.

Lessons:

- Phases of Strategic Management

- Macro Environmental Scanning

- Micro Environmental Scanning

- Tools of Analysis (SWOT, Porter’s Five Forces)

Unit 3: Organizational Strategy

Explore different organizational strategies and their application in achieving long-term business goals. Learn about corporate strategies, strategic plan audits, and stakeholder engagement.

Lessons:

- Levels of Strategy

- Strategic Plans

- Corporate Strategies

- Strategic Plan Auditing

- The Business Plan

- Stakeholder Communication & Alignment

2. Finance for Strategic Managers - Accounting

Duration: 15 Hours | Assessment: Research Paper Submission

Unit 1: Financial Data and Strategic Analysis

This module covers the foundations of strategic financial data analysis. Students will learn to interpret quantitative information, assess business risk, and utilize financial controls for informed decision-making.

Lessons:

- Understanding Financial Information, Needs, and Sources

- Risk Management in Business Strategy

- Introduction to Capital Budgeting

Unit 2: Fundamentals of Financial Accounting

Build a strong foundation in financial accounting to understand financial statements, offer

strategic recommendations, and conduct cost analysis to support strategic planning.

Lessons:

- Essential Accounting and Financial Reports

- Introduction to Financial Accounting

- Accounting for Merchandise Operations

- Inventory Accounting and Cash Flow Management

- Understanding Accounts Receivable

- Analysis of Financial Statements

Unit 3: Strategic Financial Decision-Making

This module focuses on strategic financial management techniques, exploring ways to apply financial information in strategic decision-making, manage short- and long-term goals, and drive sustainable growth.

Lessons:

- Creative Accounting Techniques for Strategic Decisions

- Cash Flow Management and Investment Proposals

- Identifying Suitable Sources of Finance

3. Finance for Strategic Managers - Finance

Duration: 15 Hours | Assessment: Research Paper Submission

Unit 1: Time Value of Money

Understanding the time value of money is crucial for financial planning, as it reflects the potential growth of funds over time. This module covers single-amount calculations, annuities, and compound interest, empowering learners to make informed decisions that optimize financial resources and return on investment.

Lessons:

- Time Value in Finance

- Future Value of a Single Amount

- Present Value of a Single Amount

- Ordinary and Due Annuities Calculations

- Mixed Annuities Calculations

- Compounding Interest Rates

- Special Applications in Financial Planning

Unit 2: Capital Budgeting Techniques

Strategic decisions often rely on effective capital budgeting to assess and prioritize investments. This module covers methods like payback periods, net present value (NPV), and internal rate of return (IRR), equipping finance professionals with tools to make long-term investment choices that align with corporate goals.

Lessons:

- Overview of Capital Budgeting

- Payback Period Analysis

- Calculating Net Present Value (NPV)

- Internal Rate of Return (IRR) for Investment Decisions

Testimonials

"This track significantly boosted my financial decision-making skills, directly impacting my career growth and organizational performance."

Sarah Al-Rashidi

Financial Analyst

"I've gained invaluable insights into strategic finance and planning, enhancing my ability to lead projects and manage budgets effectively."

Ahmad Al-Hajri

Financial Manager

"An essential track for finance professionals aiming to elevate their strategic thinking and leadership capabilities. Highly recommended!"

Youssef Al-Mutairi

Business Finance Consultant

Elevate Your Career